Aw, yer so bad

Best thing I've ever had

In a world gone mad

Yer so bad

Best thing I've ever had

In a world gone mad

Yer so bad

Things I Think I Think

As I said in my last note, this market is impervious to bad news, which is always a touch unsettling. This market is full of paradoxes. Transports are going up with energy--usually a combustable mix. Silver and gold are setting records based on inflation fears, but the Treasury market is trading like inflation is dead. Through noon today the S&P 500 is up about 2.8% in April, and up a very respectable 8.35% year-to-date.

This is not a bad thing! The other night I was at our neighborhood tavern watching the Penguins bow out of the Stanley Cup playoffs, when a friend of mine asked, "Chris, why are you so negative. The markets are soaring, you're rich, and getting richer every day. Whats not to like?" In a lot of ways he's right (though "rich" is certainly relative). Corporate profits are screaming, commodities are soaring, the economy is showing some signs of improvement (1.8% GDP growth), interest rates remain low, and we have a new Duke and Duchess of Cambridge...Love is in the air. "My sister got lucky, married a yuppie."

But what really continues to gnaw at me is that all of this is true only if you price it in dollars. My net worth (priced in dollars) has risen because the dollar has depreciated. How are we really doing, when you look at it on a global basis, priced in Swiss Francs, Australian dollars, or heaven forbid Gold? This is the difference between Nominal and Real returns. Adjusting your returns for inflation and the devaluation of the dollar.

Looking at nominal returns, we can feel good. Ignore the plunging dollar, and your lower global standard of living, you can feel good. "Aw, yer so bad, best thing I've ever had, in a world gone mad, yer so bad."

According to a recent Gallup Poll 55% of the American public seems to think we are in a recession/depression, only 27% think the economy is growing. Haven't these folks been listening to Washington and Wall Street? Is this simply a case of individuals projecting their recent past into the future? Probably. Interesting survey nonetheless.

We Have A Strong Dollar Policy:

Its official, this week both Treasury Secretary Timmy Geithner, and Federal Reserve Chairman Ben Bernanke said so!

First Geithner, "Our policy has been and will always be, as long, at least, as I'm in this job, that a strong dollar is in our interests as a country. And we will never embrace a strategy of trying to weaken our currency to gain economic advantag

e at the expense of our trading partners," he said in response to a question after a speech to the Council on Foreign Relations.

Now Ben, taking a question during his 1st ever press conference.

Reporter: There are critics who say Fed policy has driven down the value of the dollar. And a lower value to the dollar reduces the American standard of living. How do you respond to the criticism that essentially Fed policy has reduced the American standard of living?

Ben: Thanks, Steve. First, I should start by saying that Secretary of the Treasury, of course, is the spokesperson for US policy on the dollar. Secretary Geithner had some words yesterday. Let me just add to what he said, first by saying that the Federal Reserve believes that a strong and stable dollar is both in American interests and in the interest of the global economy. There are many factors that cause the dollar to move up and down over short periods of time. Over the medium term, where our policy is aimed, we’re doing two things. First, we are trying to maintain low and stable inflation by our definition of price stability. By maintaining the purchasing value of the dollar, keeping inflation low, that’s obviously good for the dollar. The second thing we’re trying to accomplish is to get a stronger recovery and to achieve maximum employment. Again, a strong economy growing with attracting foreign capital is going to be good for the dollar. In our view, if we do what’s needed to pursue our dual mandate of price stability and maximum employment, that will also generate fundamentals that will help the dollar in the medium term.

Here's where it gets good.

Reporter: Mr. Chairman one can’t help but notice it’s been unsuccessful so far.

Ben: The dollar fluctuates. One factor, for example, that has caused fluctuation has been the safe haven effect. For example, during the height of the crisis in the fall of 2008, money flowed into the Treasury market and drove up the value of the dollar quite substantially, reflecting the fact that US capital markets, are the deepest and most liquid in the world, and a lot of what you’ve seen over the last couple years is just the unwinding of that as the economy has strengthened and as uncertainty has been reduced.

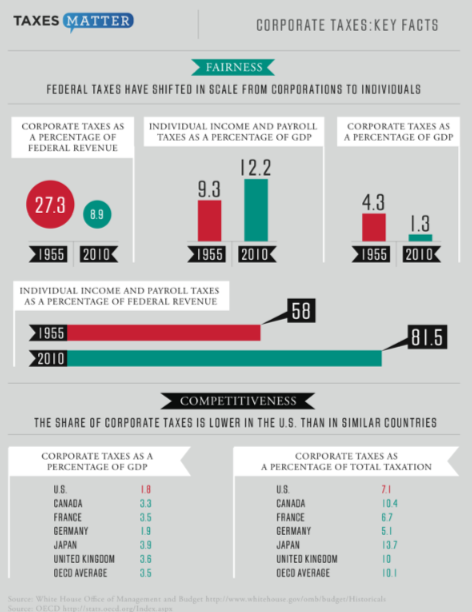

Doesn't this make you feel much better? Unfortunately as the graphs below show it is utter BS.

Be careful out there, and keep the lights on,

Chris Wiles, CFA

412-260-7917

For prior Rockhaven Views visit:

This article contains the current opinions of the author but not necessarily those of the Rockhaven Capital Management. The author’s opinions are subject to change without notice. This article is distributed for informational purposes only. Forecasts, estimates, and certain information contained herein are based upon proprietary research and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.