Let me tell you how it will be;

There's one for you, nineteen for me.

'Cause I’m the taxman,

Yeah, I’m the taxman.

There's one for you, nineteen for me.

'Cause I’m the taxman,

Yeah, I’m the taxman.

This video of President Obama set to the classic Beatles song Taxman is priceless, enjoy:

In our business it is important to constantly be on the lookout for hubris. Just when you think you've got it all figured out, along comes Mr Market to knock you down a peg or two. That's why it's critical to listen to those who have opposing views than you. Clearly the consensus view is that when the Fed finishes buying 70% of all Treasuries being issued (QE2) in June, interest rates on Treasuries "must" rise in order to attract new buyers. Bill Gross and PIMCO, the largest fixed income managers, are so sure of this outcome that they are actually short Treasuries. For a contrarian view, take a listen to this CNBC interview with one of the hottest hands in the fixed income space, Jeffrey Gundlach of Doubleline Capital ( 'Moment of Truth' Coming Soon for 2011 Investments: CEO ). Gundlach believes that the economy and the stock market are only being held up by QE2, if you take away QE2 then they'll both falter, causing interest rates to fall. Austerity is another near-term negative headwind for the economy, which will cause rates to fall. In the long-run he does believe you get a real inflationary shock, but in the near-term he sees us slipping backward, both in the economy and in interest rates.

Another contrary view, though one I'm becoming more and more of a believer in, is that a $100,000+ college degree (and debt load) is a bad investment. As with every investment you need to do a cost benefit analysis, and certain laws (such as the law of diminishing returns) hold true. Peter Thiel says higher education is a bubble, "A true bubble is when something is overvalued and intensely believed." If you have children nearing college age please read this, it is very thought provoking!

Peter Thiel: We’re in a Bubble and It’s Not the Internet. It’s Higher Education.

http://techcrunch.com/2011/04/10/peter-thiel-were-in-a-bubble-and-its-not-the-internet-its-higher-education/

http://techcrunch.com/2011/04/10/peter-thiel-were-in-a-bubble-and-its-not-the-internet-its-higher-education/

From day one I was never a fan of bailing out the banks. Even though I worked for one (National City) that didn't get a bailout (Instead PNC got the bailout money to buy NatCity). The idea of bailing out banks (as well as the auto companies, etc) is an anathema to capitalism. I could go on for pages but I won't bore you. If you want to get your blood boiling a bit read this excellent piece from our friends at Rollingstone:

The Real Housewives Of Wall Street

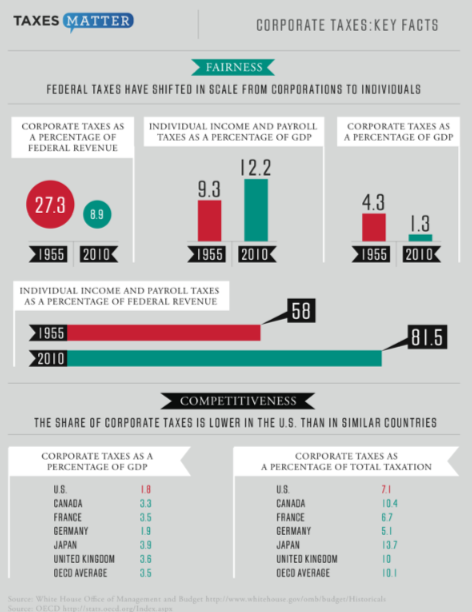

Since its tax time lets take a quick look at some tax facts.

It's widely quoted that over 50% of Americans pay no tax (even I've used that number before), but the real phrase is, "Over 50% pay no federal income tax, but they do pay payroll and state & local taxes."

The following table shows that the top 10% (>$125,000) of income earners pay about 51% of total taxes, and make about 45% of all income.

The bottom 20% (<$22,000) pay about 2% of all taxes, and make about 3.5% of all income.

While there is a lot of whining going on about how the US has one of the highest corporate tax rates, the real whining should be that our tax system is so complex and full of loop-holes that only the dumbest corporations pay anywhere near the published tax rate. As the table below shows corporate taxes are only 8.9% of Federal Revenue, down from 27.3% in 1955. On both the corporate and individual side, simple flat rates, with no loop-holes, would be much more efficient and would probably generate more revenue than our current total broken tax structure. On a personal note, my tax return came in at a weighty 81 pages.

Be careful out there, and keep the lights on,

Chris Wiles, CFA

412-260-7917

For prior Rockhaven Views visit:

This article contains the current opinions of the author but not necessarily those of the Rockhaven Capital Management. The author’s opinions are subject to change without notice. This article is distributed for informational purposes only. Forecasts, estimates, and certain information contained herein are based upon proprietary research and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

No comments:

Post a Comment