Teach your children well, their father's hell did slowly go by,

And feed them on your dreams, the one you picked, the one you're known by.

As we prepare our little ones to go back to school I started to think about money, not just about how much I'm spending, but about how to teach them about money.

When I was a kid I had a piggy bank (shaped like a rocket), and a savings account at the bank. The piggy bank got most of my loose change (other than the funds needed for the penny candy), while the bank received my earnings from grass cutting and house painting. I loved feeling the weight of that rocket as it filled with change. I still remember dreaming about what I would buy; a frisbee, or new ball. Small dreams.

I didn't realize it at the time, but I think the clink, clink of coins falling into the bank somehow encouraged responsible behavior, and made me a life long saver.

My girls don't think much about saving. They have banks, but rarely does a coin find the bottom. They have savings accounts for college/life, but those were entirely funded by us. Mostly they have their purses, where money and gift cards accumulate just long enough to make it to the mall. My girls are spenders, not savers.

This really used to bother me, but not so much any more.

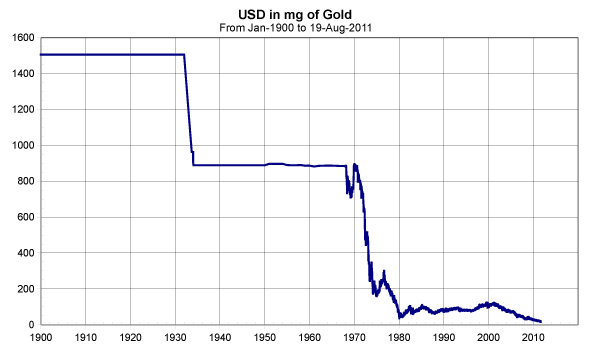

Times are different today. Our central bankers have proven that savers are saps, or sheep to be fleeced. With the constant devaluation of the dollar, and our ongoing zero interest rate policy (ZIRP), savers are losers.

Ben Bernanke recently announced that interest rates would stay at zero for the next two years. This is great news for those who have to borrow, but horrible news for any savers. Savers get zero from the bank, and then get to watch the value of their dollar based savings devalue by 5% - 7% per year. Losers.

Maybe my daughters are right, spend it before it devalues.

US Dollar priced in gold. Relatively stable until it was devalued in Great Depression, and then totally devalued after Nixon ended the gold standard.

A child of the world today has a much different relationship to money than when I grew up fifty odd years ago. Look at the lessons the world has taught them:

- Debt is wealth.

- Living beyond your means is not only acceptable, but encouraged.

- If you can't pay your debts walk away, its someone else's problem.

- The government is there to bail you out.

- We are entitled to things that we didn't work for.

- Getting rich quick is preferable to long-term saving, especially when we're not held accountable for our actions.

The world is such a different place. The dollar has not been a stable source of value for decades. The US dollar is not risk free. Everyone needs to understand that the rules have changed. For decades our governments have promised much more than they can deliver. Our governments have lived beyond their means, and have encouraged their citizens to do the same.

During the last 30 years, our government has attempted to use a combination of fiscal and monetary policy to manage the natural flow of business cycles. This was done for the noble goal of full employment. In the 25 years between 1957 and 1982 (300 months), there were 64 months that the economy was in recession. In the 25 years between 1982 and 2007 (again 300 months), there were only two shallow recessions, each lasting 8 months. On the surface it appeared that this manipulation was working, but underneath it was clear that a significant cost was being accumulated. Total Debt to GDP exploded. In other words we've been borrowing like crazy to try and mitigate natural economic declines. The problem today is that we've finally hit the end of this monetary experiment.

Source: Ned Davis Research

I'm not sure what to tell my girls about money. At the risk of being labeled a sap, I guess I'll tell them:

- To be responsible for their actions.

- Make good on your promises, even your financial promises.

- Don't trust the government to be there to bail you out. (And Dad won't always be there either).

- Save, but think really hard about where you put your savings. (Banks should be way down that list).

- Spend some too. Life is short and you might as well have some fun.

Teach your parents well, their children's hell will slowly go by,

And feed them on your dreams, the one they picked, the one you're known by.

Don't ever ask them why, if they told you, you would cry,

So just look at them and sigh and know they love you.